Trust Foundation Integrity: Building Count On Every Project

Trust Foundation Integrity: Building Count On Every Project

Blog Article

Securing Your Assets: Depend On Structure Know-how at Your Fingertips

In today's complex economic landscape, making sure the security and growth of your possessions is extremely important. Count on structures function as a cornerstone for guarding your riches and tradition, offering an organized method to property security. Know-how in this realm can use indispensable advice on browsing legal complexities, making best use of tax obligation efficiencies, and creating a durable monetary plan tailored to your unique requirements. By taking advantage of this specialized knowledge, people can not just secure their assets successfully however also lay a solid structure for long-lasting wide range preservation. As we explore the intricacies of count on structure experience, a globe of opportunities unfolds for strengthening your economic future.

Importance of Trust Fund Foundations

Depend on foundations play a crucial duty in establishing credibility and fostering solid connections in numerous professional setups. Depend on foundations serve as the foundation for moral decision-making and clear communication within organizations.

Benefits of Specialist Support

Building on the structure of rely on expert partnerships, looking for expert support supplies very useful advantages for people and companies alike. Specialist assistance offers a riches of expertise and experience that can aid browse intricate monetary, legal, or critical challenges easily. By leveraging the competence of experts in numerous areas, people and organizations can make enlightened choices that align with their objectives and aspirations.

One considerable advantage of specialist guidance is the capability to access specialized understanding that may not be easily available otherwise. Specialists can offer insights and viewpoints that can lead to ingenious options and possibilities for development. Additionally, dealing with specialists can assist reduce risks and uncertainties by providing a clear roadmap for success.

Furthermore, expert advice can conserve time and sources by enhancing procedures and preventing pricey mistakes. trust foundations. Experts can provide personalized recommendations customized to details demands, making sure that every choice is educated and strategic. Overall, the advantages of professional assistance are multifaceted, making it a beneficial possession in guarding and taking full advantage of assets for the long term

Ensuring Financial Safety

In the realm of monetary preparation, safeguarding a stable and flourishing future rest on calculated decision-making and prudent investment choices. Making sure monetary protection involves a diverse technique that includes various elements of wide range monitoring. One essential component is developing a varied investment profile customized to private risk resistance and financial objectives. By spreading financial investments across various property classes, such as stocks, bonds, realty, and assets, the risk of significant monetary loss can be alleviated.

Additionally, maintaining an emergency situation fund is vital to protect against unanticipated costs or revenue interruptions. Experts suggest alloting 3 to six months' worth of living expenses in a liquid, conveniently available account. This fund works as an economic safety net, giving peace of mind throughout unstable times.

Regularly examining and adjusting economic plans in reaction to altering scenarios is additionally vital. Life events, market fluctuations, and legislative modifications can impact monetary stability, highlighting the relevance informative post of ongoing evaluation and adaptation in the search of lasting economic safety and security - trust foundations. By carrying out these approaches attentively and consistently, people can fortify their economic footing and work in the direction of an extra protected future

Securing Your Properties Efficiently

With a solid foundation in position for economic protection through diversity and emergency fund upkeep, the next critical action is protecting your possessions properly. Protecting possessions includes securing your wide range from possible threats such as market volatility, financial downturns, lawsuits, and unexpected costs. One reliable method is property allotment, which entails spreading your financial investments across different possession courses to lower risk. Diversifying your portfolio can assist mitigate losses in one this article location by balancing it with gains in an additional.

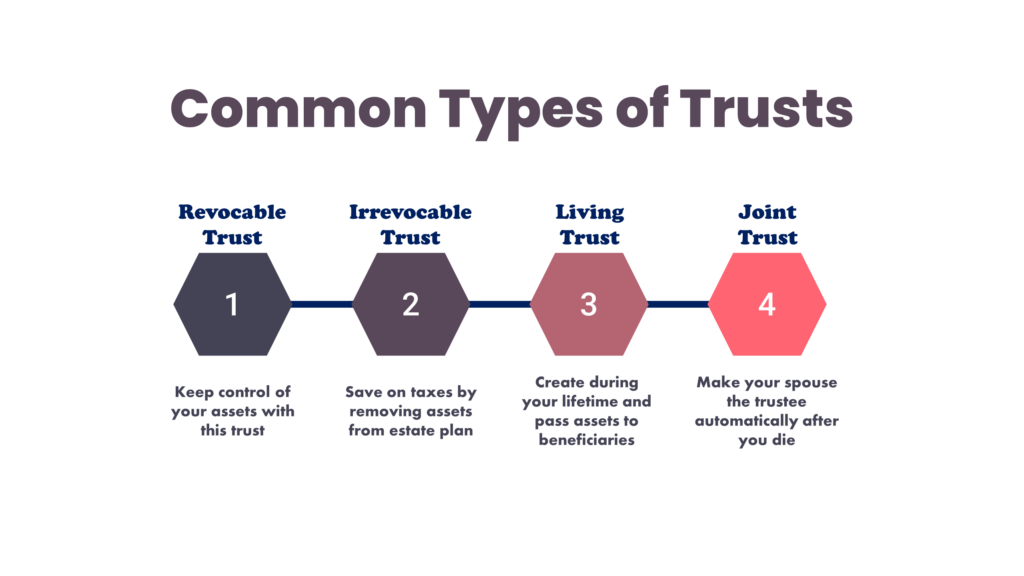

In addition, establishing a trust fund can supply a protected means to shield your possessions for future generations. Trust funds can assist you regulate how your possessions are distributed, lessen estate tax obligations, and protect your riches from creditors. By executing these techniques and seeking expert recommendations, you can safeguard your possessions effectively and safeguard your monetary future.

Long-Term Possession Defense

To make sure the long-term security of your wide range against possible dangers and unpredictabilities with time, critical preparation for long-term possession security is necessary. Long-term asset protection includes executing measures to secure your assets from various dangers such as economic slumps, lawsuits, or unanticipated life occasions. One vital facet of lasting asset defense is developing a trust fund, which can offer considerable benefits in securing your possessions from creditors and lawful disputes. By moving possession of assets to a trust, you can protect them from possible threats while still keeping some level of control over their management and circulation.

In addition, diversifying your financial investment profile is one more crucial technique visit site for long-term property protection. By taking a positive approach to lasting asset protection, you can safeguard your wealth and offer economic protection for yourself and future generations.

Final Thought

In verdict, count on foundations play a crucial function in safeguarding assets and guaranteeing monetary protection. Expert assistance in developing and managing trust fund structures is vital for lasting asset security.

Report this page